Technical Sales by Hub

The Technical Sales Leverage Effect On Quota

Determine your sales enablement budget based on annual quotas, not compensation, to see the real difference in overall sales

The impact that technical sales professionals have on overall sales is often overlooked, as I’ve learned from conversations with public and private company board members, CEOs and CROs. In fact, technical sales not only help account executives meet quota, but they can also help exceed sales quota objectives. But by how much, exactly? And why does it matter when budgeting for sales enablement?

Leverage Effect Data

Let me illustrate it for you by looking at a fictitious company called MicroForce Inc. that sells high tech SaaS, software and hardware widgets. MicroForce has a sales force that focuses on named accounts, enterprises, commercial and small to medium-sized businesses. They structure their sales teams by an average deal size of $35,000, $100,000, $250,000 and $750,000 with corresponding sales-to-technical sales ratios, quota targets and compensations as depicted in the table below:

MicroForce ’s compensation per headcount, often identified as on target earning (OTEs), typically has a mix of 70% fixed, 30% variable for technical sales and 50% fixed, 50% variable for account executives. It is common that variable compensation for technical sales is tied to the overall number of account executives and corresponding aggregate quota they support.

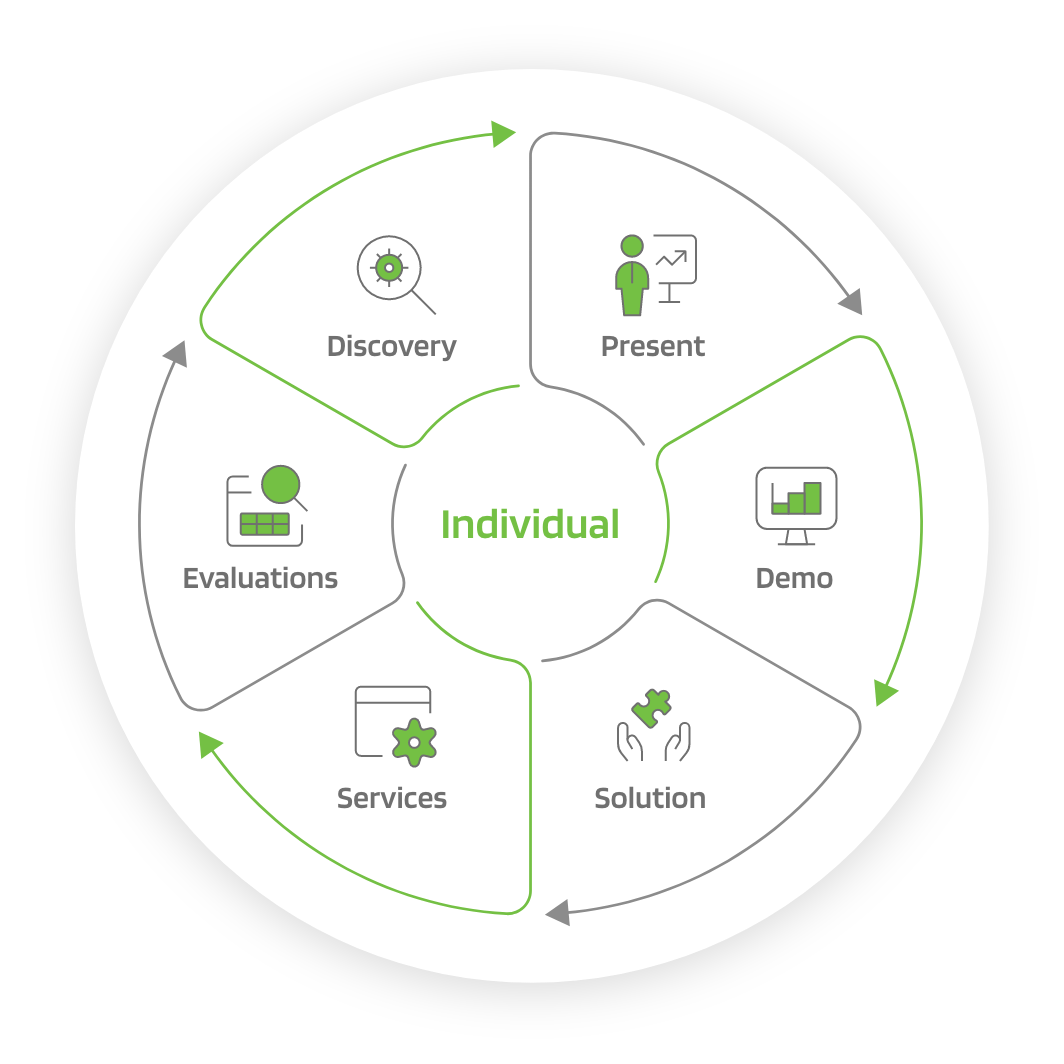

The image below shows how technical sales:account executives ratios may range from 1:10, 1:5, 1:3 and 1:1 for corresponding average deal size of $35,000, $100,000, $250,000 and $750,000. The aggregate sales quota that an individual sales engineering professional supports ranges from $7.5 million, $5 million, $4.5 million, and $3 million per year.

When looking solely at the gross gain (quota achievement minus compensation) from one sales engineering professional, the numbers vary from $7,390,000, $4,825,000, $4,300,000 to $2,750,000, assuming that both account executives and technical sales meet 100% of their sales quota. On a per-headcount basis, these numbers demonstrate significant leverage to the business from presales.

For comparison purposes, let’s look at gross gains of account executives. Comparing annual expense relative to individual contribution at 100% quota achievement, we can see that numbers are significantly less, with the exception of the $750,000 deal size, where the technical sales:account representative ratio is 1:1. The primary driver to this gross-gain gap between technical sales and account executives is the technical sales:account representative ratio.

However, the technical sales leverage effect is often overlooked when budgeting for sales enablement. For example, let’s say that a business were to budget 10% towards enablement for tooling and training. When applying the 10% budget based on annual compensation across both technical sales and account executives, there is virtually no difference between the two. However, when you apply the 10% budget based on annual quota, you can see that sales increase substantially. Think about it. By making technical sales more efficient and effective through better tooling and training, companies can boost their sales, or what I call the technical sales leverage effect. Especially in cases where technical sales support various account executives, management would be wise to request for more budget to increase the productivity and visibility of the technical sales organization.

While it may be oversimplified, I hope that this illustration demonstrates the leverage technical sales can provide to your business and how you may want to apply your sales enablement dollars. In times where all businesses are looking to drive growth and improve their margin profile, looking at technical sales is a great place to start.

Freddy Jose Mangum is the CEO of Hub that provides a SaaS technical sales engagement platform to help technical sales win more business. Freddy has over 25 years as an operator in businesses pre-revenue to $1B+ in revenue. He is a venture consultant at ForgePoint Capital and mentor to the Stanford Incubator Program (StartX).